URGENT!!! Prepare all unfinished business before death

Tips For Aging & Beneficiary Designation

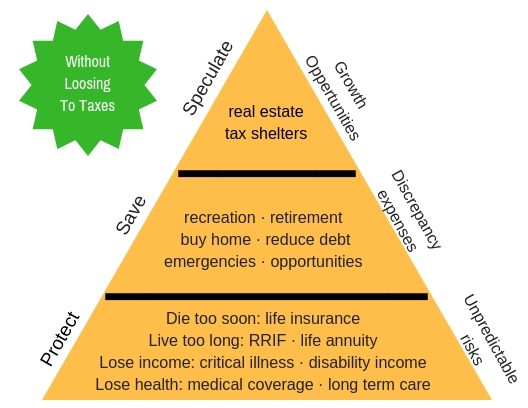

The 3 P’s of Estate Planning

“I wish to give you this information as it is very important to me.

I personally use the firm of Brian Perlin for protecting my property and my family.” – Harriet Martin

Understand the “Three P’s†— People, Property, and Plans — and how they relate to your unique circumstances.

1. People

Identify the most important people in your life. Start with yourself, your spouse (if married), children, grandchildren, your parents, in-laws, siblings and other family members or close friends. Next, list any charities, special causes, schools, or faith organizations that are important to you

2. Property

Inventory your assets in general, not every dollar or heirloom. Rough estimate of what you have.

For example, list cash, stocks, bonds, and real estate, along with their round number values. Identify any wills, trust agreements, life insurance (the death benefit, not the cash value), business interests and any inheritances you may receive.

3. Plans

Here are some important questions to consider:

- Who do you want to make your personal, health care, and financial decisions, if you become incapacitated due to an injury, illness or old age?

- Who do you want to raise your minor children, if orphaned?

- How do you want your assets distributed to your loved ones and charities?

- Do you need to provide for someone in your family with special needs?

- Do you need to protect the inheritance from some of your loved ones, as well as for them?

Careful planning can help make sure that an inheritance is a blessing and not a curse.

- Do you want your estate to avoid or pass through probate? Do you know the difference?

- Do you need to minimize estate taxes and maximize the elimination of capital gains taxes?

- Would you rather be a “voluntary philanthropist†versus an “involuntary philanthropist†when choosing which assets to benefit your favorite people and causes?

This is a short list of the considerations you should address when approaching the estate planning process. In the end, these “Three P’s†will help you enjoy estate planning peace of mind. The garage can wait … for now.

– Brain Perlin, attorney at law